Palladium

The Palladium Network: A Vision for a More Inclusive and Efficient Financial Future

Introduction

Palladium Network (PLLD) is an ERC-20 token operating on the Ethereum blockchain, built to converge tangible real estate value with high-frequency arbitrage strategies. By tokenizing select properties and channeling a portion of arbitrage profits into buybacks of Palladium's native token (PLLD), the platform provides both tangible asset security and liquidity advantages. This litepaper outlines the tokenization models, buyback mechanisms, vesting schedules, and the architectural foundations designed to democratize premium real estate ownership while incentivizing rational market behavior. Palladium converges tangible real estate value with high-frequency arbitrage to produce a more stable and transparent blockchain environment. Through fractional NFTs, investors gain direct access to income-generating properties, while arbitrage-driven buybacks anchor PLLD's market performance.

The Palladium Network is emerging as a transformative force in the financial landscape, with an ambitious vision to create a more inclusive and efficient financial future. By harnessing the power of blockchain technology and the principles of decentralized finance (DeFi), the Palladium Network aims to democratize access to financial services, reduce costs, and increase transparency. This article explores the Palladium Network's vision for a more inclusive and efficient financial future, highlighting its strategy, benefits, and potential impact.

Challenges in Traditional Financial Systems

Traditional financial systems face a number of challenges that hinder inclusion and efficiency:

- Limited Access: Many individuals and businesses, especially in developing countries, have limited access to traditional financial services, such as bank accounts, loans, and investments.

- High Fees: Traditional financial systems often charge high fees, such as transaction fees, account maintenance fees, and loan fees.

- Inefficiency: Traditional financial processes can be slow and inefficient, involving many intermediaries and paperwork.

- Lack of Transparency: Traditional financial systems are often opaque, making it difficult to track funds and understand fees.

- Exclusion: Traditional financial systems can exclude certain groups, such as individuals with poor credit or small businesses.

Key Features of the Palladium Network

Let's break down the core pillars that make PLLD a standout project in the crowded blockchain and crypto landscape.

1. Real Estate–Backed NFTs

- Palladium tokenizes select real estate assets fraction into NFTs.

- These NFTs represent direct ownership rights over income-generating properties, offering tangible value beyond speculation.

- For example, the project's first property acquisition is a scenic mountain cottage near a ski resort, currently being tokenized for community ownership.

This approach lowers barriers for entry into luxury and prime real estate, allowing even small investors to diversify into a traditionally exclusive market.

2. Automated Arbitrage Engine

- Palladium's arbitrage engine scans global exchanges for price differences.

- It executes high-frequency trades to lock in profits.

- A share of these profits is funneled back into buybacks of PLLD tokens.

This mechanism not only strengthens token demand but also helps maintain price stability, reducing the volatility typically associated with cryptocurrencies.

3. Token Buyback Mechanism

- Arbitrage profits are strategically used to buy back PLLD tokens from the open market.

- These buybacks reduce circulating supply and anchor token value.

- Investors benefit from appreciating token value supported by both real assets and ongoing arbitrage activity.

This system rewards long-term holders while discouraging short-term speculation.

4. Fractional Ownership and Accessibility

Traditional real estate investing requires large amounts of capital, complex legal procedures, and geographic limitations.

With Palladium NFTs, anyone can:

- Own fractions of prime properties.

- Receive income distributions tied to rental or property appreciation.

- Participate in a community-driven real estate economy.

This democratization of ownership is one of Palladium's biggest value propositions.

5. Sustainable Tokenomics

- Palladium's tokenomics are designed with long-term sustainability in mind:

- Vesting schedules ensure that early backers and team members align with community interests.

- Treasury management ensures profits are reinvested in asset acquisition and ecosystem growth.

- Rewards, staking, and loyalty incentives encourage holding rather than dumping.

6. Community and Governance

- Palladium isn't just about passive investment—it empowers its community:

- Decentralized treasury strategies let the community influence future property acquisitions.

- DAO-style governance ensures transparency and inclusivity.

- Airdrops and staking rewards give active participants greater benefits.

Palladium Network Vision

The Palladium Network has a vision to create a more inclusive and efficient financial future by addressing these challenges:

- Financial Inclusion: The Palladium Network aims to provide access to financial services to anyone with an internet connection, regardless of their location or credit status.

- Efficiency: The Palladium Network uses blockchain technology to automate many of the processes involved in traditional finance, reducing costs and increasing speed.

- Transparency: Blockchain provides greater transparency than traditional financial systems, allowing users to track funds and understand fees.

- Accessibility: The Palladium Network makes financial services more accessible to a wider audience.

- Empowerment: The Palladium Network empowers individuals and businesses to take control of their finances.

Strategy to Achieve Vision

The Palladium Network uses various strategies to achieve its vision:

- Asset Tokenization: The Palladium Network enables the tokenization of real-world assets, such as real estate, commodities, and securities. These tokens can be traded on decentralized exchanges, giving investors access to new markets and increasing liquidity.

- DeFi Platform: Palladium Network builds a DeFi platform that provides a variety of financial services, such as lending, borrowing, and trading.

- Partnerships: Palladium Network partners with various organizations, such as financial institutions, real estate companies, and technology providers.

- Innovation: Palladium Network continuously invests in research and development to improve the platform and offer new products and services.

- Compliance: The Palladium Network complies with all applicable regulations and works closely with regulators to ensure that the platform operates in a legal and ethical manner.

The Benefits of a More Inclusive and Efficient Financial Future

- Increased Economic Growth: Financial inclusion can drive economic growth by providing access to capital and financial services to more people.

- Poverty Reduction: Financial inclusion can help to reduce poverty by empowering individuals to increase income and build assets.

- Improved Financial Stability: A more efficient and transparent financial system can help to improve financial stability.

- Increased Innovation: A more inclusive and efficient financial ecosystem can encourage innovation and entrepreneurship.

- Increased Empowerment: Individuals and businesses will have more control over their finances.

Example: The Impact of the Palladium Network on Financial Inclusion

The Palladium Network can provide access to financial services to unbanked individuals in developing countries. By tokenizing assets and providing a DeFi platform, the Palladium Network enables these individuals to participate in the global economy and build assets.

Challenges and Risks

While the Palladium Network has the potential to create a more inclusive and efficient financial future, it is important to acknowledge the challenges and risks associated with this platform:

- Regulation: The regulatory landscape for DeFi is still evolving.

- Security: DeFi platforms are vulnerable to hacking and other cyber attacks.

- Volatility: Digital asset markets can be highly volatile.

- Adoption: DeFi adoption is still in its early stages.

- Financial Literacy: Many people lack the financial literacy necessary to participate in the DeFi ecosystem.

Tokenomics

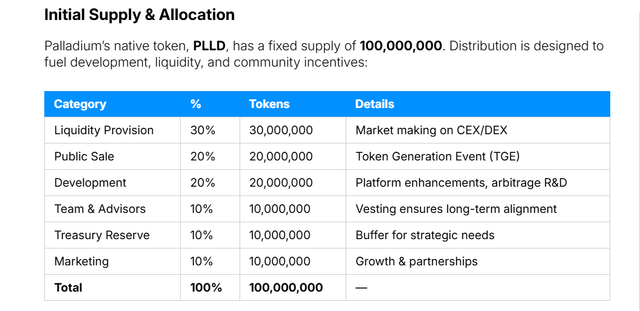

Palladium's native token, PLLD, has a fixed supply of 100,000,000. Distribution is designed to fuel development, liquidity, and community incentives:

- Liquidity Provision - 30%- 30,000,000- Market making on CEX/DEX

- Public Sale - 20%- 20,000,000- Token Generation Event (TGE)

- Development - 20%- 20,000,000- Platform enhancements, arbitrage R&D

- Team & Advisors - 10%- 10,000,000- Vesting ensures long-term alignment

- Treasury Reserve - 10%- 10,000,000- Buffer for strategic needs

- Marketing - 10%- 10,000,000- Growth & partnerships

Vesting Schedules

Development (20%)

- Lockup: 6 months post-TGE

- Vesting: Gradual release from Month 7 onward, aligning with platform milestones (eg, Swap launch, real estate tokenization).

Team & Advisors (10%)

- Lockup: 6 months post-TGE

- Vesting: Linear over 25 months to maintain focus on long-term success.

Treasury Reserve (10%)

- Lockup: 12 months post-TGE

- Vesting: Linear release, offering flexibility for unforeseen requirements and strategic expansion.

Marketing (10%)

- Lockup: None

- Vesting: 25% released at TGE, remaining 75% over the next 12 months to support sustained growth and user acquisition.

These schedules prevent sudden token floods, safeguarding market stability and incentivizing ongoing project development.

Buyback Mechanism

Central to Palladium's sustainability is a profit-sharing buyback system, where a portion of PLLD's arbitrage returns fund repurchases:

- Arbitrage Earnings: Profits generated from market inefficiencies are channeled into the buyback pool.

- Periodic Token Buys: At random intervals, Palladium buys PLLD on the open market to thwart predictable front-running and speculation.

- Supply Reduction: Tokens are transferred to the treasury or retired, potentially effectively shrinking circulating supply and supporting the token's market value.

Transparent Reporting" Quarterly disclosures detail total tokens repurchased, expenditure, and transaction references for on-chain or exchange verification.

Roadmap

Phase 1 (0–6 Months)

- Expand arbitrage coverage to multiple exchanges

- Conduct buybacks from initial trading profits

- Complete preliminary audits

Phase 2 (6–12 Months)

- Launch PLLD Swap

- Roll out first fractional real estate NFTs

- Integrate advanced arbitrage (options, futures)

Phase 3 (12+ Months)

- Diversify global property portfolio

- Implement AI-based arbitrage modules

- Maintain ongoing buybacks and periodic vesting updates

Conclusion

The Palladium Network has an ambitious vision to create a more inclusive and efficient financial future. By harnessing the power of blockchain technology and DeFi principles, the Palladium Network aims to democratize access to financial services, reduce costs, and increase transparency. While there are challenges and risks associated with this platform, the potential benefits of a more inclusive and efficient financial future are substantial.

Stay connected with us:

- Website: https://plld.net/

- Twitter: https://x.com/DDTechGroup

- Telegram: https://t.me/Palladium_PLLD

- Whitepaper: https://plld.net/whitepaper

- View PLLD on CoinGecko: https://www.coingecko.com/en/coins/palladium-network

- Forum Username: Lumbalumbi

- Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=3357701

Komentar

Posting Komentar